Given its dominant position in the aerospace market, one would think Boeing's (BA) monthly returns would be less volatile than the S&P 500 index (VOO). But, Boeing has endured a lot in the past few years. First came the trade war with China that froze Boeing out of the second-largest aerospace market in the world. Then came the COVID-19 pandemic that grounded airlines worldwide and brought Boeing to its knees. We did not even talk about the 737 Max plane crash in Ethiopia that kicked off the disastrous few years for Boeing.

Boeing has never fully recovered from either the trade war or the pandemic. Boeing remains frozen out of the Chinese market, and airlines are only now seeing air travel return close to pre-pandemic levels (Exhibit 1).

Exhibit 1: TSA Checkpoint Travel Number September 17, 2022 - September 26, 2022

|

| TSA Checkpoint Travel Numbers (Source: TSA.GOV) |

Now, the world is grappling with slowing growth due to high inflation and interest rates, which is putting further pressure on Boeing. By the looks of it, Boeing stock may take a decade or more to recover its losses if it ever recovers. Boeing's stock has dropped from $440 in March 2019 to $127 as of September 27 - a loss of 71%.

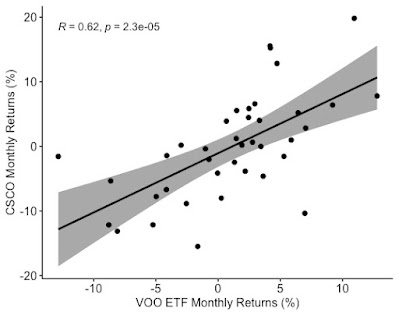

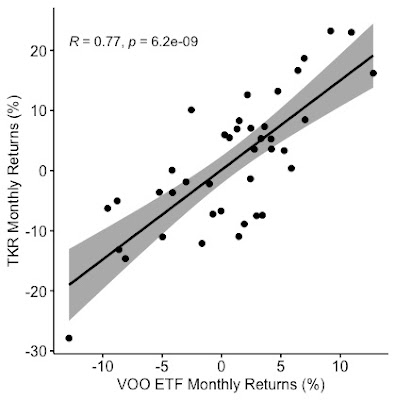

Due to these massive crises, Boeing's stock returns have become unhinged from that of the S&P 500 index. A linear regression of the monthly returns of the Vanguard S&P 500 Index and Boeing yields a very high beta of 1.35 (slope of the regression line). The value of 1.35 is the coefficient of the monthly returns of the Vanguard S&P 500 Index ETF (VOO). Yahoo Finance displays a beta of 1.36 based on 5-year monthly returns. One can expect any change in the Vanguard ETF to be magnified by Boeing. For every 1% change in monthly returns of the S&P 500 index, Boeing's monthly returns are expected to change by 1.35%. Also, just 25% (Adjusted R-Squared in the RStudio output below) of Boeing's returns are explained by the monthly returns of the S&P 500 Index.

Exhibit: Vanguard S&P 500 Index ETF and Boeing Monthly Returns [June 2019 - August 2022]

|

Vanguard S&P 500 Index ETF and Boeing Monthly Returns [June 2019 - August 2022]

(Source: Data Provided by IEX Cloud, Author Calculations Using RStudio) |

Here's the output from the linear regression conducted on RStudio:

> lmBAVOO = lm(BA_Monthly_Return~VOO_Monthly_Return, data = VOOandBA)

> summary(lmBAVOO)

Call:

lm(formula = BA_Monthly_Return ~ VOO_Monthly_Return, data = VOOandBA)

Residuals:

Min 1Q Median 3Q Max

-0.26036 -0.07433 -0.00562 0.07323 0.33452

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -0.02348 0.02007 -1.169 0.249682

VOO_Monthly_Return 1.35442 0.36247 3.737 0.000628 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.1229 on 37 degrees of freedom

Multiple R-squared: 0.274, Adjusted R-squared: 0.2543

F-statistic: 13.96 on 1 and 37 DF, p-value: 0.0006279

![Monthly Returns of Sealed Air Corp. and Vanguard S&P 500 Index ETF [June 2019 - August 2022] Monthly Returns of Sealed Air Corp. and Vanguard S&P 500 Index ETF [June 2019 - August 2022]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiSotWsT6tTgW3luCt3iEODsOGn6pJipMggQ7pPQGYBcAlf4iKukfkRVUeQTsczXHCcnq-UB_KpqWfO6NICzwZRHWTbICKW2ksTSfIdmfzWYYUIr90GSUdM-1qhnJEvdLRNsVhDXAAWzyOGc9w6Z_eA8TH0eMf13oaLwvQubU0-3lrLsvAe2sv0F7lu/w400-h315/Rplot01.jpeg)