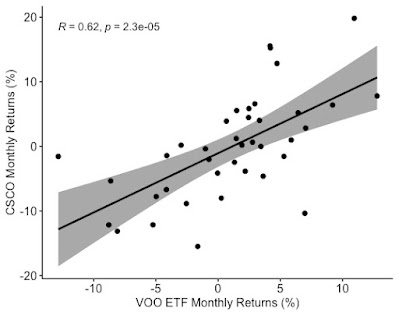

Here is the graph of monthly returns of Cisco Systems (CSCO) plotted against Vanguard S&P 500 Index ETF (VOO):

Exhibit 1: Monthly Returns of Cisco Systems and Vanguard S&P 500 Index ETF [June 2019 - August 2022]

|

| Monthly Returns of the Vanguard S&P 500 Index ETF and Cisco Systems Inc. |

(Source: RStudio, ggplot, Data Provided by IEX Cloud)

Results of the linear regression of monthly returns of Cisco Systems against Vanguard S&P 500 Index ETF:

VOOandCSCO <- read_excel("/CSCO_VOO_LM_September_2022.xlsx", sheet = "Sheet1")

lmCSCOVOO = lm(CSCO_Monthly_Return~VOO_Monthly_Return, data = VOOandCSCO)

summary(lmCSCOVOO)

Call:

lm(formula = CSCO_Monthly_Return ~ VOO_Monthly_Return, data = VOOandCSCO)

Residuals:

Min 1Q Median 3Q Max

-0.156924 -0.031998 -0.008248 0.038045 0.127839

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -0.01062 0.01049 -1.012 0.318

VOO_Monthly_Return 0.91708 0.18946 4.841 2.31e-05 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.06426 on 37 degrees of freedom

Multiple R-squared: 0.3877, Adjusted R-squared: 0.3712

F-statistic: 23.43 on 1 and 37 DF, p-value: 2.306e-05

The slope of the regression corresponds to the beta of the stock. In this case, Cisco Systems has a beta of 0.91.

The adjusted R-squared is 0.37. About 37% of Cisco's monthly return is explained by the returns of the S&P 500 index.

Cisco Systems cannot protect a portfolio against market volatility since it has a beta value close to 1. Cisco's stock will almost entirely reflect the volatility in the market.

No comments:

Post a Comment