Summary:

- Describe the AI money flow using an illustration.

- How much do Adobe, Salesforce, and others spend on Research and Development (R&D)?

- How has the R&D expense changed over time?

- What can we infer about the impact of GenAI on R&D expenses?

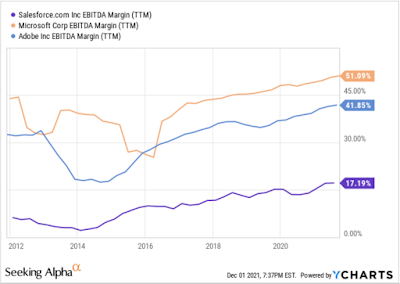

In this post, we examined Microsoft's capital expenditures (capex) as a proxy for the billions of dollars hyper-scaler cloud providers are investing in AI. Who is consuming this capex? We will answer this fundamental question in this post. Most people may already know the answer to this question. Cloud providers are packaging Nvidia GPUs into various IaaS services, offering them to companies such as Adobe, ServiceNow, Salesforce, and every other company in every industry experimenting with GenAI. These companies' investments in AI show up in research and development expenditures in the income statement.

The AI Money Flow

Here's how the investments in AI flows through various companies. Let's look at each step.

Nvidia designs the GPUs.

Taiwan Semiconductor Manufacturing Company (TSMC) brings Nvidia's dreams to the market.

Dell, HP, and other server manufacturers, primarily based in Asia, buy these GPUs from Nvidia and package them into servers. The cost of the GPUs is included in the server manufacturers' Cost of Goods Sold (COGS).

Cloud providers purchase these servers. The cost of these AI servers is included in the capital expenditures.

Companies worldwide purchase IaaS and PaaS services created by cloud providers to experiment with and create various AI products and services for their customers.

Github Copilot, Salesforce's Einstein AI, ServiceNow AI agent, Apple Intelligence, and other products are examples of GenAI in the marketplace.

Once a product is ready to be released, companies typically create a SaaS service and introduce their GenAI products to consumers and other companies across various industries.

Consumers and companies pay for the GenAI service. Many services currently have a free and paid tier. The free service may typically have some restrictions on product use.

Companies such as Apple, Delta Airlines or Expedia build Chatbots, which they hope would help increase revenue, reduce the cost of serving their customers and thus boost their profit margins. But, most companies bringing GenAI products to market will have to see cost reductions in their operations soon or generate a profitable revenue stream.

Note about #2:

By now, most people are familiar with Jensen Huang, the unassuming, charismatic Nvidia founder. Most people probably have never heard of Morris Chang - the unassuming, spotlight-shunning, nonagenarian Taiwan Semiconductor Manufacturing Company (TSMC) founder. Here are a couple of articles to learn more about him:

The Chip Titan Whose Life’s Work Is at the Center of a Tech Cold War

He Turned 55. Then He Started the World’s Most Important Company.

Note about #5:

The cloud providers themselves are massive users of the GPUs they purchase. Internal product teams at Amazon and Microsoft are experimenting with and creating new GenAI products. These product development expenses appear as research and development (R&D) expenses. So, in addition to spending billions on capital expenditure, Amazon, Microsoft, and Google are racing to create new genAI products and, in turn, invest billions more in R&D.

Companies like Adobe, Apple, ServiceNow, Salesforce, and others are investing in GenAI R&D to create new products. Since Adobe, ServiceNow, and others do not buy the GPUs directly and maintain, for the most part, their own data centers, they rely on the cloud providers for their GPU and include the cost of buying those services in R&D. In this post, we will examine how those R&D expenses have changed for these companies with the advent of GenAI.

Note about #7:

When a product is released to the market by the R&D teams, the responsibility of maintaining the service is turned over to the Cloud Operations and Support teams at Adobe, Salesforce, ServiceNow, and others. The cost of providing these services to customers and the associated GPU use is included in the cost of goods sold (COGS).

Research and Development Spending By Companies

Apple's R&D Spending

Apple is one of the largest companies on the planet in terms of revenue, profits, and market value. They have also been slow to announce AI services, only recently announcing Apple Intelligence. Apple is a big R&D spender with one of the largest R&D budgets in the world. Apple spent nearly $30 billion on R&D in 2023.

Chart: Apple's Annual R&D Expense (2007 - 2023)

Table: Apple's Annual R&D Spending

Apple has increased its R&D budget by 38x since 2007. With the GenAI race just getting started, I do not see these massive expenses abating anytime soon. When you look at the chart below the R&D expense (yellow bar) compared to Revenue (blue bar) looks so tiny.

In fact, Apple only spent 7.8% of revenue on R&D. But, this is the company's highest spend in terms of dollar amounts and as a percent of revenue. The company increased its R&D spend by 114 basis points from 2022, adding over $3 billion to its R&D expense. Apple's motivation to release AI products and services may be behind this increase in R&D expense, especially at a time when its revenue declined from 2022 to 2023.

Chart: Apple's Annual R&D Spending Compared to Revenue

Table: Apple's R&D Expense As a Percent of Revenue.

Salesforce's R&D Expense

Let's look at R&D spending by Salesforce and how that's changed over time and feeling the pressure to invest in GenAI. Here's Salesforce's R&D expense compared to its annual revenues.

Chart: Salesforce's Revenue (blue bar) and R&D Expense (yellow bar)

Table: Salesforce's Revenue and R&D Expense as a Percent of Revenue

Salesforce has been spending above 14% of its revenue on R&D since 2017, well above Apple's expenditure in this category. Salesforce has probably decided that it is spending much on R&D already and only needs to reallocate, prioritize funds and teams to focus on GenAI projects.

Microsoft's R&D Expense

Microsoft is already spending plenty on capex. It is spending billions more on R&D. But as a percent of revenue, the company has not increased its spending. On dollar terms Microsoft has definitely increased it spending. Its R&D expense as a percent of revenue in 2024 was lower compared to 2023. But, in dollar terms the company increased its spending by over $2 billion.

Chart: Microsoft Revenue and R&D Expense

Table: Microsoft's Revenue, R&D Expense, and R&D as a Percent of Revenue

Companies that have were already spending well above 10% on R&D have probably prioritized the budgets with a focus on GenAI. Megatech companies such as Apple and Microsoft have increased their R&D expense by a few billion dollars. These fresh dollars are mostly likely focused on creating new AI products and services.

Disclosures: I am a Sales Engineer at Snowflake. All opinions in this blog post are solely mine and do not reflect Snowflake's views. I am not a Registered Investment Advisor, and any discussion on securities or investments is not an inducement to make a particular investment.