Equinix (EQIX):

Wednesday, March 10, 2021

Equinix: Technical Set-up Looks Good

Tuesday, March 2, 2021

I am going to buy Total S.E. (NYSE: TOT) on any short-term weakness

Total S.E. is on Bank of America's Top Rated Stocks list. When I saw that name, I was intrigued. Why is an oil giant from Europe on this list? I have done my research and found out that they have a growing green energy portfolio for which they are not getting much credit now. I am going to buy on any short-term weakness (below $45 may be a start) and put it away for a long time and keep collecting the dividend (6.6%).

Monday, August 17, 2020

Bank of America Adds AES Corp to US1, Removes Ameren Corp.

On August 13, 2020, Bank of America added AES Corp., (NYSE: AES) to its US-1 List. According to the bank, the US 1 list is the collection of the their best investment ideas that is subset of their buy-rated stocks. The bank has now removed Ameren (NYSE: AEE) from that list.

AES has had a huge run since May 11, 2020. It has risen from $11.87 on May 11 to $17.67 on August 17. That's a 49% gain in three months. It may be wise to wait for a pull back before adding the stock to your portfolio. A good entry point may be around $14.39. Currently, the money flow indicator is in overbought territory and the stock is hugging the upper part of the Bollinger Bands.

Exhibit: AES Corp., has had a huge run

Disclosure: I do not own AES or Ameren

Sunday, August 16, 2020

Barron's Recommends Merck, But Is it a Buy At $83.

Barron's has recommended Merck (NYSE: MRK) stating that the company does not get "enough credit". Merck is currently trading at $83.48. The price is currently hugging the upper part of the Bollinger Band. The money flow indicator is approaching over-bought territory and currently sits at 60. The MACD is flashing a buy signal. All the moving averages are currently flashing a buy. If there's any pullback, the stock may be a buy at $75 or $76.

Exhibit: Merck May Be a Buy at $75 or $76.

(Source: Tradingview)

Exhibit: Merck Oscillators

(Source: Tradingview)

Large Insider Buy at Pfizer Made Me Look At that Stock

Barron's has reported that Pfizer's Director Ronald Blaylock has made the largest open-market purchase of the stock since 2003. Mr. Blaylock paid $510,000 on August 6th for 13,000 Pfizer (NYSE: PFE) shares. The Director has paid an average price of $38.53 for the shares. The stock has been trading lower and as of Friday, August 14, 2020, it was trading at $38.06. The money flow indicator is nearing oversold territory and the MACD is flashing a sell signal. A good entry point for the stock may be around $37.70. There seems to be support for the stock at this level. If the stock breaks below $37, another entry point would be around $32.50. The stock was at that level when the money flow indicator was in oversold territory on July 24, 2020.

Exhibit: Entry Points for Pfizer

(Source: Tradingview)

Tuesday, August 11, 2020

Exited my position in Redfin and Energy Recovery

I had written about Energy Recovery Inc., (NASDAQ: ERII) on my blog on July 25, 2020. I had taken a small position in Energy Recovery on July 24, 2020 at $7.70. Since then the stock has had a nice run and I sold my position today at $8.50 for a 10.3% gain. The technical indicators are still flashing a buy for Energy Recovery. But the stock has had a sharp run-up. The MACD also had a bearish crossover and that was partly the reason for my sell. The Relative Strength Index was at 63 today and I did not wish for it be in the over bought territory before I sold this position.

Exhibit: Energy Recovery Technical Indicators on August 11, 2020.

I took a position in Redfin on August 10, 2020 at a price of $41.80. I never had full conviction for this trade. I felt Redfin (NASDAQ: RDFN) was too overvalued and there were too many uncertainties in the economy and in the housing market. Given the loss of unemployment benefits for millions of Americans, I wasn't sure how this was going to impact the demand for housing. The Federal Reserve has done an admirable job of lowering the interest rates and stabilizing the financial markets. But even they cannot create jobs or pay unemployment benefits or prevent evictions. So, I felt that the economy is in a very precarious position. In this current situation, I did not want own a company like Redfin. It may be a speculative bet at these valuations and economic conditions. I sold Redfin at $43.50 for total gain of 4%.

Monday, August 10, 2020

Is Redfin a buy at $41.80?

Redfin (NASDAQ: RDFN) - the real estate brokerage company - had a great Q2 2020. Revenue increased by 8% y-o-y to $214 million. The company did book a $4 million operating loss but that was down from $12 million in the same quarter in 2019. The ultra low mortgage rates are benefiting the company. But given the pace of home sales there's very low levels of available homes for sale.The company has provided good guidance for the third quarter.

Exhibit: Redfin had a down day today, but the stock may not have hit bottom

(Source: Tradingview)

There could be support for the stock at around the $41 level. If the stock drops below the support level at $39, that may be a very bearish sign for the short-term. On the upside there could be resistance for the stock at $43.65. My limit order got triggered today at $41.80 and it ended the day at $41.70. If it passes $43.65 it could go to new all-time highs. Majority of the Wall Street analysts are neutral on the stock with a target of $39.50.

(Disclosure: I own Redfin)

A 6% return on Caterpillar in 6 days

I bought Caterpillar (NYSE: CAT) at $131.60 on August 4, 2020. I had visualized my trade in a previous blog post on this stock. I had placed a limit order at $139.97 or just below the $140. The limit got triggered today for a return of 6.3% in six days. My rational was that the stock could face some resistance just about $140 and wanted to exit my position at that level.

Exhibit: Caterpillar trade set-up between August 4 and August 10, 2020

Sunday, August 9, 2020

Barron's says buy Vodafone, are they correct?

On August 6, 2020, Barron's magazine published an article on Vodafone (NASDAQ:VOD) stating that the shares have bottomed based on the following reasons:

- The company has put together €1 billion cost cutting plan.

- Potential upside from introduction of 5G.

- Assets that they have marked for disposal could generate cash and dispose of under performing assets.

- The demand for data is exploding due to the lock down caused by the COVID-19 pandemic.

The company saw lower churn rates partly because of the pandemic driven lock downs. The company is also reaffirming its guidance and estimates that it will generate €5 billion in free cash flow. Germany is Vodafone's largest and most important market. It accounts for 34% of the company's EBITDA. Given that Germany has the virus under control, that market has been resilient through this global crisis.

Exhibit: Vodafone's Most Important Market is Germany

(Source: SeekingAlpha)

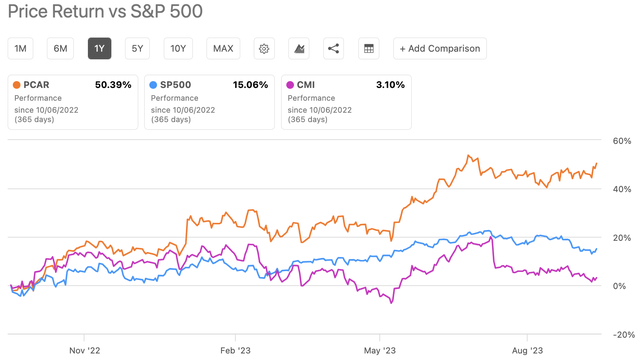

Paccar: Peak Demand For Trucks

Paccar ( PCAR ) produced 185,900 trucks in 2022 and is on track for another record year in 2023. The company has experienced good revenue ...

-

The Vanguard Industrials Index ETF ( VIS ) touched a 52-week high of $202.86 on Friday, June 16 (Exhibit 1) . Exhibit 1: Vanguard Industr...

-

The Chemours Company is a diversified chemical company serving multiple industries. Here are its products: Exhibit 1: Here's the graph o...

-

Hormel Foods own several iconic brands shown in the images below. Source: Hormel Foods Corporation Hormel Foods ( HRL ) has averaged a low...