Here's the histogram of Corning's (GLW) monthly returns between June 2019 and October 2022 (Click on the image to see a larger version):

Exhibit: Corning's Monthly Returns Fell at or below 2.56% for the Majority of the Months

|

| Data Provided by IEX Cloud, Author Calculations |

There were 14 months between June 2019 and October 2022 when Corning's monthly returns were greater than 2.56%. There were seven months when the monthly returns were greater than or equal to 11.5%.

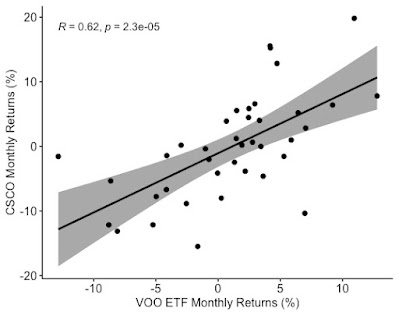

Corning's monthly returns have a high positive correlation of 0.66 with the monthly returns of the Vanguard S&P 500 Index ETF (VOO).

Exhibit: The Vanguard S&P 500 Index and Corning Monthly Returns [June 2019 - October 2022]

|

| Data Provided by IEX Cloud, Monthly Returns Calculated by the Author, Graph using RStudio |

A linear regression of the Vanguard S&P 500 Index ETF and Corning's monthly returns yields a beta of 1.03 for Corning. Corning's average monthly return will mirror the Vanguard S&P 500 Index ETF. Corning may not help diversify a portfolio and will not protect against the market's volatility.

Here's the linear regression model:

> # Conduct the Linear Regression of the Monthly Returns Between $VOO and $GLW

> lmVOOGLW = lm(GLW_Monthly_Return~VOO_Monthly_Return, data = VOOandGLW)

> # Present the summary of the results from the linear regression

> summary(lmVOOGLW)

Call:

lm(formula = GLW_Monthly_Return ~ VOO_Monthly_Return, data = VOOandGLW)

Residuals:

Min 1Q Median 3Q Max

-0.118363 -0.050928 -0.009998 0.041106 0.187435

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -0.003778 0.010818 -0.349 0.729

VOO_Monthly_Return 1.039148 0.188256 5.520 2.4e-06 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.06823 on 39 degrees of freedom

Multiple R-squared: 0.4386, Adjusted R-squared: 0.4242

F-statistic: 30.47 on 1 and 39 DF, p-value: 2.403e-06

The coefficient for VOO_Monthly_Return [1.039148] is the beta for Corning. The p-value is significant at a 95% confidence interval. The adjusted R-squared is 0.42, which means about 42% of Corning's average monthly return is explained by the Vanguard S&P 500 Index ETF returns.

![Monthly Returns of Sealed Air Corp. and Vanguard S&P 500 Index ETF [June 2019 - August 2022] Monthly Returns of Sealed Air Corp. and Vanguard S&P 500 Index ETF [June 2019 - August 2022]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiSotWsT6tTgW3luCt3iEODsOGn6pJipMggQ7pPQGYBcAlf4iKukfkRVUeQTsczXHCcnq-UB_KpqWfO6NICzwZRHWTbICKW2ksTSfIdmfzWYYUIr90GSUdM-1qhnJEvdLRNsVhDXAAWzyOGc9w6Z_eA8TH0eMf13oaLwvQubU0-3lrLsvAe2sv0F7lu/w400-h315/Rplot01.jpeg)